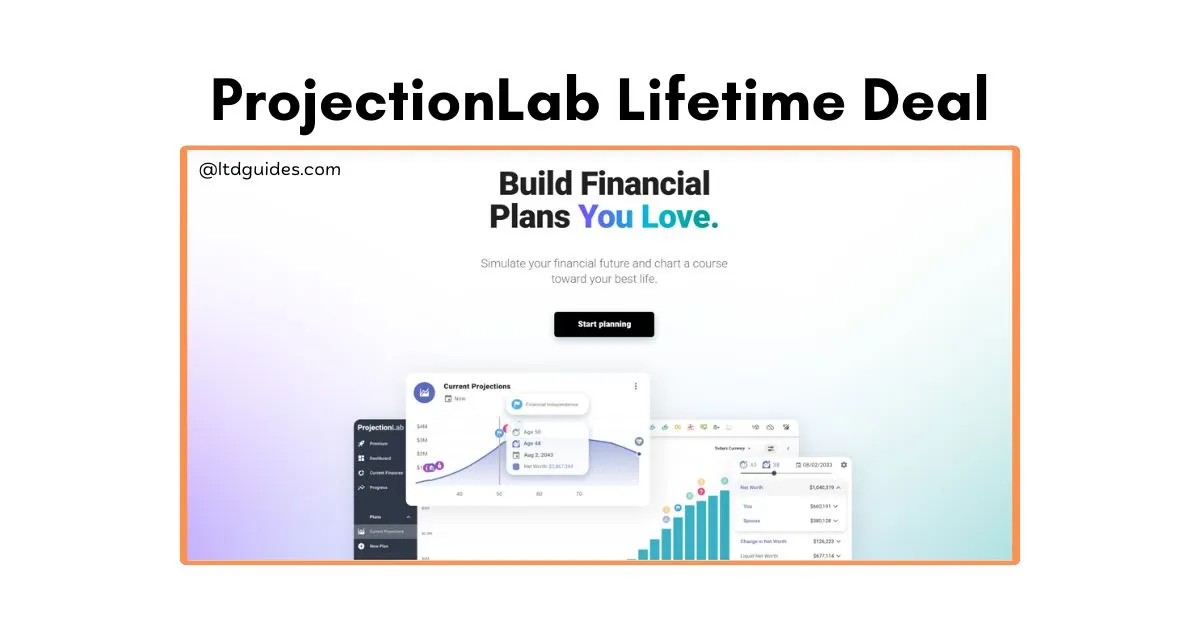

ProjectionLab is a powerful financial planning tool that helps you simulate and visualize your financial future with clarity. It models accounts, income, expenses, assets, and liabilities to create realistic, year-by-year projections. With customizable milestones and multi-condition rules, you can represent real-life decisions like phased retirement or debt payoff.

Built-in Monte Carlo simulations and tax analytics show a range of outcomes and the chance of success. You keep control of your data with optional cloud sync or local storage, and no account linking is required. The interface makes a complex planning approachable for beginners and deep enough for advanced users.

What is ProjectionLab?

ProjectionLab is a web-based financial planning app that models your savings, investments, real assets, and debts across your lifetime. It creates interactive, year-by-year projections with charts for net worth, assets, liabilities, and cash flow. The tool supports conditional milestones, Monte Carlo simulations, tax estimates, and international presets to test different scenarios. You control your data storage, cloud sync, browser-only, or manual import/export—without linking to live financial accounts.

Key Features of ProjectionLab Lifetime Deals

If you want a planning tool that treats your financial life like a story with options, not a single forecast, read these features closely. ProjectionLab’s Lifetime Deal unlocks tools that make scenario testing, tax planning, and privacy simple so you can build plans that actually fit your life.

- Elegant scenario modeling: Create detailed, multi-phase plans with conditional milestones to reflect real decisions like phased retirement or prioritized debt paydown.

- Monte Carlo chance-of-success: Run thousands of simulations to see median outcomes and failure probabilities, giving a realistic range of possible futures.

- Detailed tax analytics: Get year-by-year tax estimates and visuals to test Roth conversions, withdrawals sequencing, and cross-account strategies.

- Cash flow visualization: View Sankey diagrams and breakdowns that show exactly where money comes from and where it goes each year.

- Account and liability modeling: Track taxable accounts, tax-advantaged accounts, real estate, mortgages, and loans with custom contribution and drawdown rules.

- Data control and privacy: Choose cloud sync via Google Firebase, browser-only localStorage, or manual import/export for complete control over your data.

- Historical backtesting: Compare strategies against past market history to understand how plans would have performed in different eras.

- International presets: Use tax and account templates for multiple countries to test relocation or global financial plans easily.

- Progress tracking and journaling: Record your actual net worth over time and compare it to projections to refine assumptions and behavior.

- One-time premium access: The Lifetime Deal gives you ongoing access to advanced features without recurring subscription fees, ideal for long-term planners.

The Benefits of ProjectionLab Lifetime Deals

ProjectionLab’s Lifetime Deal turns sophisticated financial modeling into a long-term asset: pay once and keep a powerful planning studio that grows with your life. The deal removes subscription friction and encourages ongoing experimentation, learning, and confidence in your financial choices.

- Cost savings over time: A single payment eliminates monthly fees, making it cheaper than subscriptions if you plan to use the tool for several years.

- Ongoing access to updates: Lifetime users benefit from new features and improvements without repeated purchases or renewals.

- Privacy and data control: Keep your financial models private with options for local storage, cloud sync, or manual import/export.

- Deep scenario testing: Run many what-if cases and Monte Carlo simulations to understand risks and plan for uncertain markets.

- Better decision-making: Visualizations, tax analytics, and year-by-year breakdowns help you choose strategies that fit your goals and temperament.

- Long-term motivation and tracking: Track actual net worth against projections and journal progress to stay accountable and adjust plans.

- Great value for planners and advisors: Individuals, aspiring early retirees, and advisors all gain a robust, shareable tool without ongoing subscription costs.

Who will use ProjectionLab Lifetime Deals?

ProjectionLab Lifetime Deal is ideal for people who want a durable, private, and powerful financial planning toolkit without subscription churn. It’s best for anyone who likes to test realistic scenarios, track progress over time, and make confident long-term choices.

- Individuals pursuing financial independence: People aiming for FIRE can model multi-phase retirements, sequence withdrawals, and test aggressive savings plans.

- Busy professionals planning retirement: Those with limited time can quickly build a realistic plan and update it annually without reconnecting accounts.

- Parents planning family finances: Households facing education, childcare, and housing expenses can simulate trade-offs and prioritize goals over decades.

- People with complex finances: Owners of rental properties, side businesses, or multiple income streams can model taxable and retirement accounts together.

- Expats and international movers: Users considering relocation can test country-specific tax presets and compare after-tax outcomes across jurisdictions.

- Financial advisors and coaches: Professionals can use Pro features to illustrate scenarios for clients and facilitate clearer financial conversations.

- Privacy-minded planners: Anyone wary of linking bank accounts will appreciate manual data entry, local storage options, and optional cloud sync.

FAQs: about ProjectionLab Lifetime Deals

What is ProjectionLab, and who is it for?

ProjectionLab is a web-based financial planning application that models savings, investments, liabilities, and life events across your lifetime. It’s designed for people who want detailed, customizable projections—ranging from beginners planning retirement to advanced users modeling multi-phase FIRE scenarios.

What does the Lifetime Deal include?

The Lifetime Deal grants one-time access to ProjectionLab’s premium features without recurring subscription fees. That typically includes advanced visualizations, Monte Carlo simulations, tax analytics, data persistence options, and other premium capabilities available at the time of purchase.

How does ProjectionLab handle my data and privacy?

ProjectionLab does not require linking to live financial accounts. You can choose cloud sync via Google Firebase, use browser-only localStorage, or import/export flat files manually, giving you control over where and how your data is stored.

Can ProjectionLab run Monte Carlo simulations, and what do they show?

Yes. ProjectionLab runs thousands of stochastic simulations to produce a distribution of possible outcomes, median trajectories, percentile bands, and an estimated chance of success for your plan. These outputs help quantify risk and give a realistic sense of how often a plan might succeed under different market paths.

Does ProjectionLab provide tax estimates and international presets?

ProjectionLab offers tax analytics with year-by-year estimates and supports international presets for several countries. This helps you evaluate tax-sensitive strategies, compare after-tax outcomes, and test relocation scenarios with country-specific templates.

Can I model complex life events and conditional milestones?

ProjectionLab supports multi-condition milestones and decision rules so you can represent phased retirements, conditional early retirement triggers, housing purchases, and other realistic behaviors. These milestones allow your plan to respond dynamically to portfolio size, age, or other conditions.

ProjectionLab Review – Final Thought

ProjectionLab puts powerful, realistic financial planning tools in your hands without surrendering your privacy or paying recurring fees. Whether you’re chasing early retirement, managing complex assets, or simply want clearer control over your money, the Lifetime Deal gives you long-term access to advanced simulations, tax insights, and flexible milestones. The visualizations and year-by-year detail turn abstract hopes into actionable plans you can test and trust.

By paying once, you unlock a living planning studio that grows with your life and helps you make better decisions with less stress. If you value clarity, control, and the ability to explore many futures before committing, ProjectionLab is a smart, cost-effective choice. Start modeling your best financial path today and watch your confidence—and options—grow.