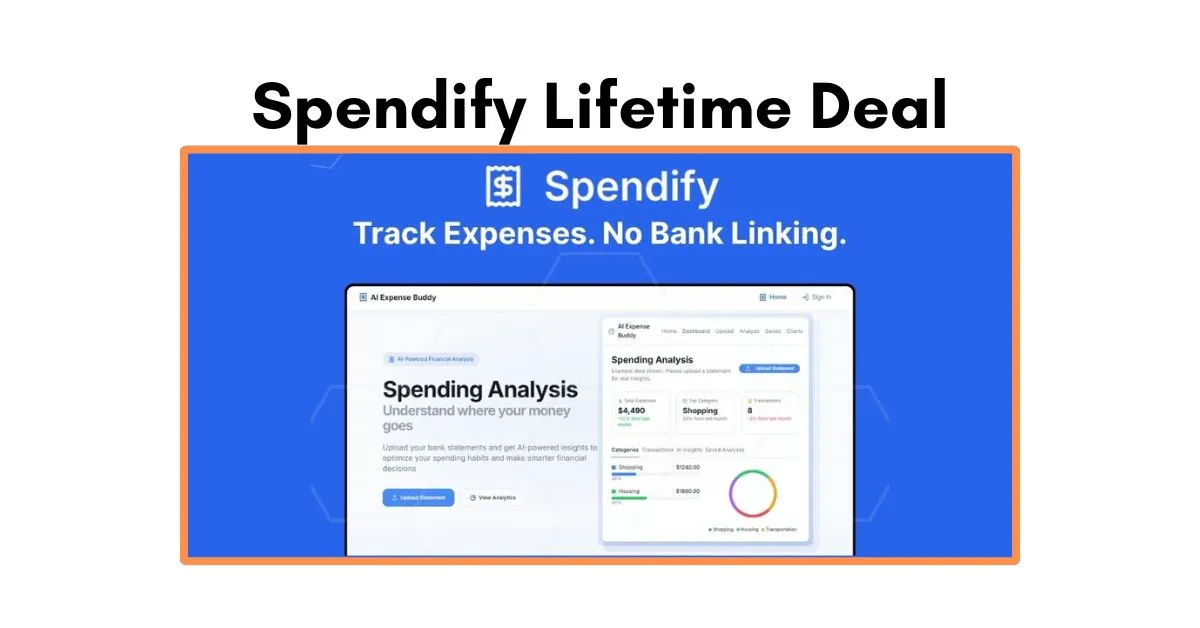

Managing money shouldn’t feel like a mystery or a monthly chore. Upload your bank statements and get instant, easy-to-understand breakdowns that show exactly where your cash goes. No bank logins, no spreadsheets—just clear categories, visual charts, and practical tips.

Spendify Lifetime Deal gives you one payment for ongoing access to powerful expense analysis and budgeting tools. With privacy-first uploads and AI-driven insights, you can finally make spending choices that support your goals. Start turning confusing statements into confident financial decisions today.

What is Spendify?

Spendify is an AI-driven expense manager that analyzes bank statements without requiring bank logins. It auto-categorizes transactions, highlights spending trends, and offers personalized budgeting suggestions. The platform works with PDFs, CSVs, and TXT files for quick, private analysis. Designed for simplicity, Spendify turns raw statements into clear financial guidance.

Key Features of Spendify Lifetime Deals

Want a finance tool that actually saves you time and shows you where to act? These features turn confusing statements into meaningful actions, so you can cut waste and grow savings. Read each point carefully — they’re built to make budgeting painless.

- Easy Statement Upload: Upload PDFs, CSVs, or TXT files and let Spendify parse every transaction automatically. No manual entry or bank linking means faster setup and greater privacy.

- Categories Analysis: Spending is grouped into clear categories like Housing, Food, and Transport, with visual charts to show where money goes. This makes spotting budget leaks immediate and intuitive.

- Transactions Dashboard: A searchable, filterable table lists every transaction with merchant, date, and category. Quick review or deep search lets you find anomalies or recurring charges fast.

- AI Financial Insights: Automated suggestions highlight overspending, savings opportunities, and trends that matter. Insights are written in plain language so you can act without confusion.

- Budget Planner: Set budgets with simple sliders and receive AI-backed recommendations tailored to your income and goals. Adjustments are reflected in real time for practical control.

- Financial Goals: Create and track goals like emergency funds or short-term savings targets with progress bars and milestone nudges. Seeing progress boosts motivation to stick to plans.

- Alerts & Notifications: Get nudges when you exceed budget limits or when unusual activity appears in your statements. Timely alerts help prevent surprises and keep money on track.

- Saved Analyses Archive: Store past analyses and revisit them to compare months or years of spending. Historical context helps measure improvement and refine future budgets.

- Advanced Financial Analysis (Ultimate Tier): Access security and health scores, recurring payments detection, cash flow trends, merchant breakdowns, and tax-related tagging. This level is ideal for users needing deeper financial visibility.

- AI Financial Advisor: Ask questions about optimizing budgets, trimming subscriptions, or building safety nets and receive personalized, data-driven responses. It’s like having a finance coach on demand.

The Benefits of Spendify Lifetime Deals

Investing once in a tool that provides lifetime access removes subscription stress and aligns long-term financial planning with affordability. The lifetime option makes advanced features accessible without recurring fees, so you can rely on consistent tools as your finances evolve. Value and predictability combine to help you commit to smarter money habits.

- Cost Savings Over Time: A single payment eliminates monthly or yearly fees, which becomes more economical the longer you use the platform. This frees budget space for other priorities or investments.

- Privacy-First Approach: No bank linking keeps sensitive credentials off the platform while still allowing deep transaction analysis. Users maintain control over their financial data and upload only what they choose.

- Faster Financial Clarity: Automated parsing and categorization cut the time needed to understand spending patterns. Instead of hours with spreadsheets, get immediate charts and insights.

- Better Budget Discipline: Real-time nudges and AI recommendations make it easier to stick to spending limits. Seeing the impact of small adjustments helps build lasting habits.

- Useful for Taxes and Planning: Tax-relevant tagging and merchant breakdowns simplify bookkeeping and tax prep. Freelancers and small businesses gain clarity for reporting and planning.

- Scalable for Needs: Tiered upload limits and premium analyses let users start small and expand as complexity grows. That flexibility supports students to small business owners.

- Historical Tracking: Archived analyses let you measure progress across months and years. Longitudinal views reveal improvements and recurring problem areas to address.

- Actionable Advice: AI-driven tips move beyond vague suggestions to specific steps you can implement. Practical advice leads to measurable changes in spending and savings.

Who Will Use Spendify Lifetime Deals?

This tool is designed for anyone who wants straightforward expense management without linking accounts and who values long-term access to financial tools. It suits people who need clarity, control, and privacy while keeping costs predictable. From students to small business owners, Spendify fits varied financial situations and goals.

- Students: Track daily expenses and meal budgets with minimal setup and no bank linking required.

- Freelancers: Separate business and personal transactions from uploaded statements for clearer profit views.

- Young Professionals: Set savings targets, trim subscriptions, and build emergency funds with AI guidance.

- Small Business Owners: Gain merchant-level spending insights and cash flow trends to improve operational decisions.

- Micro-entrepreneurs: Understand profitability and recurring costs without complex accounting software.

- Parents Managing Households: Monitor household spending categories and set family budgets that are easy to follow.

- Side Hustlers: Keep part-time income and expenses organized for better tax prep and growth planning.

FAQs: About Spendify Lifetime Deals

What formats does Spendify accept for statement uploads?

Spendify accepts PDF, CSV, and TXT bank statement files for analysis, making it flexible for most users. Uploads are parsed automatically, so you don’t need to reformat records.

Do I need to link my bank account to use Spendify?

No, Spendify works without bank linking; you upload statement files directly, preserving control over credentials and reducing security risks.

How accurate is Spendify’s transaction categorization?

The AI-driven categorization is highly accurate and improves over time, with options to correct or reclassify transactions if needed for fine-tuned results.

How many statements can I upload with a lifetime plan?

Upload limits depend on the tier you choose; options include monthly allowances like 50, 200, or unlimited uploads, so pick the one that fits your usage pattern.

Will Spendify help me prepare for taxes?

Yes, Spendify tags tax-relevant transactions and provides merchant-level breakdowns that simplify bookkeeping and tax reporting for freelancers and small businesses.

What security measures protect my uploaded statements?

Spendify uses secure file handling and storage practices, offers safety scoring, and does not require bank credentials, keeping your sensitive information more private.

Spendify Review | Conclusion

Spendify gives you the clarity and control to stop wondering where your money goes and to start making informed decisions. A single lifetime purchase removes subscription worry and delivers ongoing value as your financial life changes. Its privacy-first upload model and AI insights make budgeting practical and actionable for everyday users.

Whether you need tax-ready reports, goal tracking, or smarter spending habits, Spendify brings professional-level tools within reach. If long-term cost savings and clearer money management matter to you, this lifetime deal is worth serious consideration. Take the step now and make Spendify a permanent part of your financial toolkit.